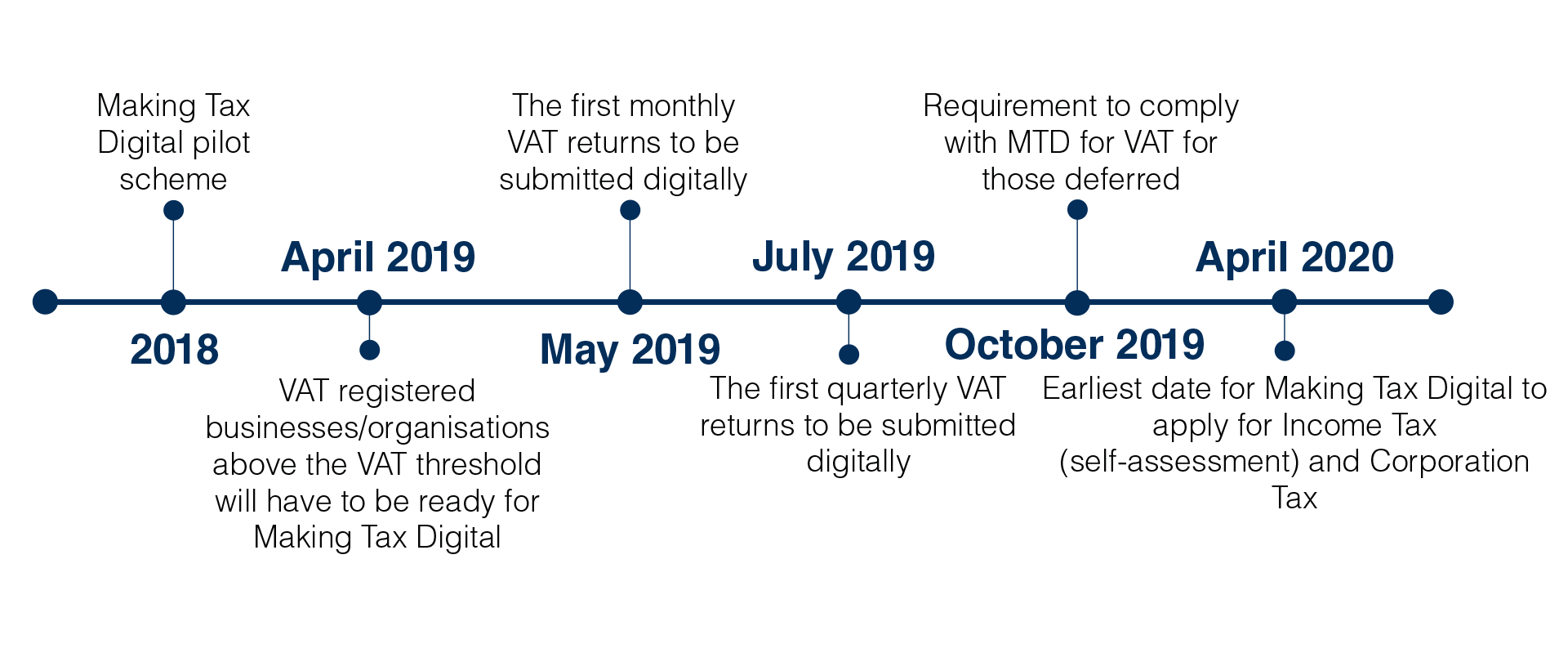

April 2019

- VAT registered businesses/organisations with a turnover over £85k.

- From the beginning of the first VAT period after this date there will be a need to keep digital records and make VAT submissions via software.

October 2019

HMRC has deferred for 6 months the adoption of MTD for VAT for the following:

- Trusts

- “Not for profit” organisations that are not set up as a company

- VAT divisions and VAT groups

- Certain public sector entities required to provide additional information on their VAT return

- Local authorities and public corporations

- Traders based overseas

- Those required to make payments on account

- Annual accounting scheme users

There will be a requirement to comply with MTD from the beginning of the first VAT period starting after 1st October 2019.

April 2020 (at the earliest)

- For Income Tax (self-assessment) and Corporation Tax.

- HMRC have said that this will only happen when MTD is working; a pilot for Income Tax is well underway.

- Previously Income Tax was to start in April 2018 for businesses above the VAT threshold, but this has now been delayed until April 2020 at the earliest.