Xero has standard UK VAT rates pre-set. You can add your own rates as necessary if the default rates do not meet your needs, or edit the default rates - pay particular attention to the 'Tax type' as this determines how these rates are reported.

It may be best to contact your accountant or bookkeeper if you are unsure of how to set your tax rates up. The default tax names and their rates set up in Xero are:

| Name | Tax Rate |

| 20% (VAT on Expenses) | 20% |

| 20% (VAT on Income) | 20% |

| 5% (VAT on Expenses) | 5% |

| 5% (VAT on Income) | 5% |

| EC Acquisitions (20%) | 0% |

| EC Acquisitions (Zero Rated) | 0% |

| Exempt Expenses | 0% |

| Exempt Income | 0% |

| No VAT | 0% |

| Reverse Charge Expenses (20%) | 0% |

| VAT on Imports | 0% |

| Zero Rated EC Goods Income | 0% |

| Zero Rated EC Services | 0% |

| Zero Rated Expenses | 0% |

| Zero Rated Income | 0% |

You'll also have these additional default rates if you use the flat rate VAT scheme:

| Name | Tax Rate |

| 20% (VAT on Capital Sales) | 20% |

| 20% (VAT on Capital Purchases) | 20% |

How and where are tax rates used?

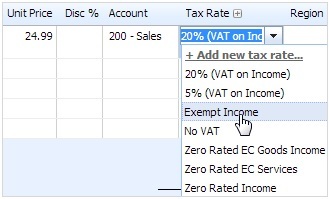

- Each line item you enter in Xero has a tax component - whether these are items on sales invoices you are sending to customers, bills you are receiving from suppliers, bank transactions to record money you have spent or received, manual journals or expense claims.

- All tax recorded in Xero is reported in the VAT Return and the VAT Audit Report so that at anytime you can see how much tax you have charged or paid.

- The default list of rates displayed are those already provided by Xero based on standard UK VAT rates provided by HMRC. You can edit these and add your own custom rates as required.

- You can set standard rates for each account in the Chart of Accounts. The 'Accounts using this Tax Rate' column refers to the accounts in your Chart of Accounts that will use these rates by default. This means that whenever you 'code' a transaction to a particular account, for example, Sales, a preset tax rate will be applied automatically.

- If you don't want to use the default tax rates you can enter your own and if appropriate, make these rates the default for particular accounts in your Chart of Accounts. You can use any tax rate on any invoice, bill or transaction regardless of whether it is the default rate on an account.

- Alternatively, you can lock these rates. The padlock icon shows on locked tax rates, which can't be deleted. A locked rate can be set either as a default rate on one of your accounts or on a repeating invoice or bill.

For further information including details of the training and support that we offer please email xero@streetsweb.co.uk